Thinking about your money situation can feel like looking at a really big picture, with lots of pieces to sort out. It's about more than just what you have right now in your wallet or bank account. Really, it’s about figuring out where you stand financially, seeing the full scope of your possessions and what you might owe. This kind of personal accounting, sometimes called net worth tracking, offers a clear view of your financial health at any given moment. It’s a simple way to get a handle on your money life, helping you see things more clearly, you know?

This idea of knowing your financial standing, that, is that it gives you a kind of personal report card for your money. It tells you the total value of everything you own after taking away everything you owe to others. So, it's almost like a snapshot, a single picture that shows your financial position at one particular time. This picture can be very helpful for anyone, whether you're just starting out or have been working with money for a while. It gives you a solid place to begin when thinking about your money goals.

Many people find that keeping an eye on this number helps them feel more in control of their money story. It’s a way to measure how well you are doing over time, to see if your efforts are paying off. You might find it surprisingly simple to figure out your own number, and it can be quite empowering. This simple calculation, in some respects, provides a base for making thoughtful choices about your financial future, helping you move closer to where you want to be.

Table of Contents

- What Exactly Is Your Financial Picture?

- Why Does Knowing Your Net Worth Really Matter?

- How Do You Figure Out Your Net Worth?

- What Do Others' Net Worth Numbers Mean for You?

What Exactly Is Your Financial Picture?

Your financial picture, often called your net worth, is a pretty straightforward idea when you break it down. It’s basically everything you own, like your savings, investments, or even things with value like a car or a home, minus everything you owe, such as student loans, credit card balances, or a mortgage. So, in other words, it’s a quick way to see the actual financial standing of a person or a business. This figure gives you a very clear idea of your current money situation, almost like a financial report card that shows you where you stand right now.

Everyone, no matter their age or financial situation, actually has a net worth number. It might be a small number, or a big one, or even a number below zero if what you owe is more than what you own. Knowing this number is a pretty important first step towards gaining control over your money. It helps you see the whole picture, not just bits and pieces. You know, it's like having a map for your money journey, showing you your current spot.

This simple calculation gives you a starting point, a place to begin your money management efforts. It’s not just a random number; it represents the value of all your possessions after accounting for all your financial obligations. Figuring this out can feel a little bit like taking stock of your life’s financial inventory. It’s a moment of clarity, a way to truly grasp your personal money situation, and it can be quite revealing, too.

- Kacey Musgraves Bikini

- Cakes Of Paradise Bakery

- How About 8 Inches And Thick

- %D9%85%D8%A7%DB%8C%DA%A9 %D8%AA%D8%A7%DB%8C%D8%B3%D9%88%D9%86

- Pioneer Court Chicago

Getting a Handle on Net Worth Tracking

Once you understand what net worth is, the next step is getting a handle on net worth tracking. This means keeping an eye on that number over time. It’s not a one-time calculation; it’s something you check in on regularly, perhaps once a month or every few months. This consistent checking allows you to see if your money choices are moving you in the direction you want to go. For instance, if you pay down debt, your net worth typically goes up. If your investments grow, it also goes up. This simple process, you know, helps you see your progress.

The idea behind net worth tracking is to use this single piece of information to follow your financial path. It’s a way to measure how well you are doing in building up what you own and reducing what you owe. By seeing this number change, you can feel a sense of accomplishment or identify areas where you might need to adjust your spending or saving habits. It’s a very practical way to stay connected to your money goals and make sure you are on the right path, or pretty close to it.

Many people find that the act of regularly checking their net worth can be a powerful motivator. It helps you stay focused on financial well-being. This kind of consistent attention to your money picture is a core part of personal financial care. It’s a simple habit that can lead to big changes over time, helping you build a stronger financial foundation, in a way, for your future. So, it's more or less about staying aware and making small, consistent efforts.

Why Does Knowing Your Net Worth Really Matter?

Knowing your net worth really matters because it gives you a true picture of your financial health. It’s not just about how much money comes in each month, but about the total value of your financial standing. This figure provides a quick look at your money position, helping you to size up how well you are doing and measure your financial progress. It’s like getting a report card for your money, showing you your overall grade. This can be very helpful for making big financial choices, too, like buying a home or planning for retirement.

This snapshot of your financial health at a particular moment is a very useful piece of information. It's one data point you can use to follow your progress over time. Without it, you might feel a little lost when it comes to your money, not quite sure if you're moving forward or standing still. Knowing this number helps you set realistic goals and see if you're actually achieving them. It gives you a solid foundation for making thoughtful decisions about your money, you know, helping you feel more secure.

Beyond just tracking progress, understanding your net worth can help you spot potential problems before they become bigger issues. If your net worth is going down, it might signal that you are spending too much or not saving enough. If it's going up, it shows your efforts are paying off. It provides clarity and helps you stay on top of your money situation. This kind of clear view is pretty important for anyone hoping to build a strong financial future, as a matter of fact, and it gives you a sense of control.

How Can Net Worth Tracking Help You Grow?

So, how can net worth tracking actually help you grow? Well, by keeping an eye on this number, you gain a powerful tool for personal financial development. It helps you see the direct impact of your money decisions. When you save more, pay off debt, or make wise investments, your net worth typically goes up, which feels pretty good. This immediate feedback can encourage you to keep making smart choices. It's almost like a score in a game, showing you how well you're playing your money game.

This kind of tracking also helps you set more specific and achievable financial goals. Instead of just saying, "I want more money," you can say, "I want my net worth to increase by a certain amount this year." This makes your goals much more tangible and gives you something concrete to work towards. It helps you focus your efforts and make a plan. You know, it’s a very practical way to turn vague wishes into real steps, helping you build financial strength over time.

Furthermore, regular net worth tracking can help you stay motivated even when things get tough. There might be times when your investments go down, or unexpected expenses come up. But by consistently tracking, you can see the long-term trend, which is usually upward if you are making good choices. This long-term view helps you stay positive and committed to your financial well-being. It’s a constant reminder of your progress, you know, giving you a reason to keep going and grow your financial picture.

How Do You Figure Out Your Net Worth?

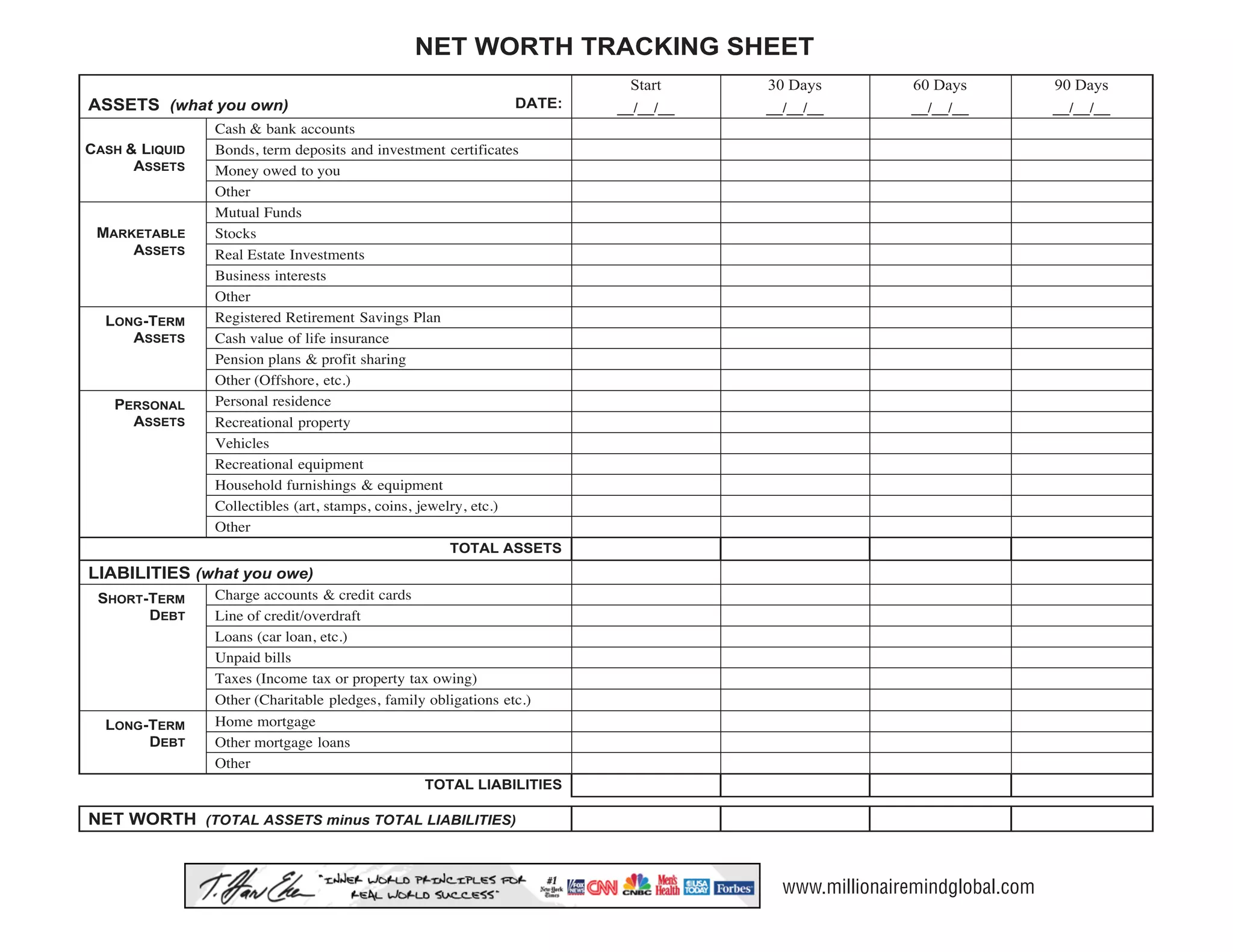

Figuring out your net worth is pretty simple once you gather all the necessary details. It’s just your assets, which is everything you own that has value, minus your liabilities, which is everything you owe. Everyone has this number, and it’s a pretty good idea to find out what yours is. To do this, you just need to list out all your possessions that have financial worth and then list out all your debts. It’s a basic calculation, but it provides a very clear picture of your financial standing, you know?

Let's break it down a little bit. Your assets could include things like the cash you have in your checking or savings accounts, any money you have in retirement funds or investment accounts, the value of your home if you own one, and even things like your car or other valuable possessions. Then, your liabilities are things like your mortgage balance, any car loans, student loans, credit card debt, or other money you owe to banks or individuals. Once you have these two totals, you simply subtract the total amount you owe from the total amount you own. That number is your net worth, basically.

This calculation gives you a current snapshot, a single moment in time. It’s a very useful piece of information because it shows you exactly where you stand financially. You don't need a fancy degree to do it; it's straightforward arithmetic. Knowing this figure is a key step towards understanding your personal finances and setting yourself up for a stronger financial future. It's a foundational piece of information, pretty much, for anyone wanting to get a grip on their money.

Tools for Simple Net Worth Tracking

When it comes to tools for simple net worth tracking, there are quite a few options available that can make the process much easier. You don't have to do it all with pen and paper, though that works too. Many people use free calculators found online to quickly figure out their number. These tools usually ask you to input your assets and liabilities, and then they do the subtraction for you, giving you your net worth in moments. It’s a very convenient way to get started, you know, without much fuss.

Some online platforms and apps even let you track your net worth over time. They connect to your bank accounts, investment accounts, and even loan accounts, pulling in the numbers automatically. This means you can see your net worth update regularly without having to manually input everything each time. These types of tools often provide charts and graphs that let you see your progress visually, which can be very motivating. It’s a bit like having a personal financial assistant, always keeping an eye on your numbers, so.

One such resource, like Networthshare, for example, helps you calculate your net worth and track it online. These kinds of services often let you publicize your net worth anonymously, if you choose, and compare it to others. They might even offer interactive charts that let you break down your financial picture in different ways. This makes net worth tracking not just a chore, but an engaging activity that helps you stay on top of your money. It’s a way to simplify a sometimes complex topic, pretty much, making it accessible to everyone.

What Do Others' Net Worth Numbers Mean for You?

You might hear about the net worth of other people, perhaps the median or average numbers for a country or group. For instance, the median net worth of all Americans in 2022 was about $192,900. The average net worth, which tends to be higher because of a few people with extremely large amounts of money, was around $1.06 million. So, what do these numbers mean for you personally? Well, they can offer a kind of perspective, but they are not really a direct measure of your own success. They are more like benchmarks, giving you a general idea of where others stand, you know?

It’s easy to look at these figures and feel a certain way, whether it's encouraged or a little discouraged. However, it's important to remember that everyone's financial journey is quite unique. These average or median numbers are just statistics; they don't tell the full story of individual circumstances, life choices, or starting points. They can be interesting to look at, perhaps to understand broader economic trends, but they shouldn't be the sole basis for judging your own financial progress. Your own path is what truly matters, basically.

Instead of focusing too much on how your net worth compares to an average, it's usually more helpful to focus on your own personal growth. Your net worth tracking is about your own journey, your own goals, and your own improvements. While it's natural to be curious about others, using those numbers as a direct comparison can sometimes lead to unnecessary pressure or unrealistic expectations. It’s better to use your own past self as the main point of comparison, seeing how far you have come and where you want to go next, really.

Can Net Worth Tracking Be a Community Thing?

So, can net worth tracking be a community thing? In a way, yes, it can. While your personal net worth is a private matter, the idea of sharing financial experiences, even anonymously, can build a sense of community. Platforms that allow you to publicize your net worth without revealing your identity, and then compare it to others, tap into this desire for connection and shared experience. It’s a way to see how you stack up without exposing your personal details. This kind of shared data can help people feel less alone in their financial journeys, you know?

When people can see where they stand relative to others, even if it's just a general comparison, it can foster a sense of shared learning and motivation. It’s not about competing, but about understanding broader patterns and perhaps drawing inspiration from others' progress. This communal aspect of net worth tracking, where data is aggregated and presented, can provide a bigger picture of financial well-being across different groups. It helps to normalize discussions around money, which can sometimes be a bit of a private topic, typically.

These community-focused tools for net worth tracking can also provide valuable insights into general financial trends and what it takes to reach certain money milestones. They show that becoming an "everyday millionaire," for example, is something many people work towards and achieve. Seeing these collective numbers can be encouraging and help individuals set their own aspirations. It’s a way to turn a solitary financial pursuit into something that feels a little more connected to a larger group, giving you a sense of belonging, as a matter of fact, within a shared financial landscape.

This article has covered the core ideas of net worth tracking, starting with what net worth actually means – the value of what you own minus what you owe. We looked at why keeping track of this number is so important for seeing your financial health and measuring your progress. We also explored how to calculate your net worth by adding up your assets and subtracting your liabilities, and mentioned some helpful tools, including online calculators, that can make this process easier. Finally, we touched on what it means to compare your net worth to others, and how net worth tracking can even become a shared experience, offering perspective and motivation.

Related Resources:

Detail Author:

- Name : Alexzander Mueller III

- Username : destinee98

- Email : goldner.gaston@hotmail.com

- Birthdate : 1987-08-15

- Address : 5967 Dayana Station Apt. 382 Alejandrinberg, GA 62913-8518

- Phone : +17277897516

- Company : Kris-Huels

- Job : Floral Designer

- Bio : Repellat ut aperiam dolorum ipsam. Animi et quod sapiente.

Socials

facebook:

- url : https://facebook.com/heatherjacobson

- username : heatherjacobson

- bio : Quidem sit placeat illo facilis est.

- followers : 2576

- following : 2103

instagram:

- url : https://instagram.com/heather_id

- username : heather_id

- bio : Voluptatum deleniti quibusdam quae accusantium numquam. Non quibusdam ut ratione. Autem ut id ut.

- followers : 6669

- following : 696

linkedin:

- url : https://linkedin.com/in/hjacobson

- username : hjacobson

- bio : Debitis eos dicta qui consequatur ad harum.

- followers : 1664

- following : 1530

tiktok:

- url : https://tiktok.com/@heather8561

- username : heather8561

- bio : Earum beatae sed saepe magni quaerat velit maiores.

- followers : 6933

- following : 2586